NATWEST

Covid Hub & financial tools creation

The Challenge

NatWest needed to quickly understand how to help their Business Banking customers deal with the disruption of Covid-19. We needed to build a solution that would provide access to bespoke financial tools as well as no-nonsense assistance to applying for Government loans.

My role

-

Working closely with Experian and NatWest to define opportunities and work with strategic data

-

Leading a UX team on mobile-first design solutions

-

Mapping customer flows and capturing technical dependencies as well as legal requirements

-

Facilitate and create project kick-off stakeholder workshop

-

Create a user testing strategy, complete testing, and analyse findings

-

Creating customer surveys (NPS - CSAT - CES) and ensuring implementation

Business tools on which I was CX lead

Supply chain checker

Customer confidence was low. Anxiety and uncertainty lead to people behaving irrationally. I led the experience and definition of the Supply Chain Checker working closely with NatWest and Experian to quickly find the best and most feasible solution

Forecast cash flow

Initially, this standalone digital tool was created for helping business owners to assess cash flow and highlight any areas of risk. After testing, it was apparent that Business owners were requiring a solution that would integrate with existing accounting tools

Coronavirus Business Pulse Check

It was apparent in the first weeks of CBILS loan applications, that many businesses were applying for the wrong scheme. We created a Q&A solution which would filter relevant information for business owners in less than a minute. We even emailed results to those who requested as well as providing download solutions

FOCUS ON:

Experian collaboration sessions

Research and customer feedback had showed that businesses were losing existing supply chains and having to set up new solutions. But trust was low. This was causing stress and delays which in turn affected other businesses and customers.

We involved Experian to develop a 'lite' credit check tool to asses new suppliers, free for anyone, that would give between 3-6 months of historical financial data, enough to make an informed decision whether the business was still reliable and functioning well enough during the pandemic.

Below: Remote workshop flow mapping with Experian API integration

BETA RELEASE OF SUPPLY CHAIN CHECKER

Based on customer insights and rapid user testing

We released the first iteration of the tool after I had conducted appetite and requirement testing through remote mobile testing using Lookback.io.

The tool slowly gathered traction and we had a mix of feedback within the first 3 weeks mainly due to peoples understanding of 'how' a credit check is to be read, and 'what' is actually being assessed to provide the score.

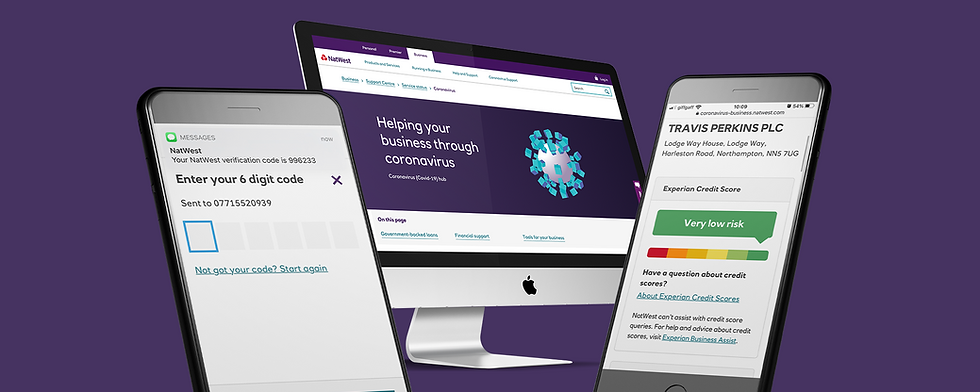

One time pass code

To minimise 'abuse' of the Experian API which was charging NatWest per interaction, a code was required to activate the tool. Though in testing this was an area of friction, people understood that the value exchange was worth it.

Experian credit score playback

The data visible from credit checks was the high level credit score and also days beyond term payments. It was deemed that these were the most critical elements to allow businesses to assess the recent risk of new suppliers in these difficult times

CSAT and VoC programme

Every tool had CSAT and CES survey built in. By continually reviewing these we made slight adjustments to wording and are now looking into creating a 'Beta Panel' amongst customers for future product releases

FOCUS ON

Testing tool features and prioritisation

Key customer insights from testing that would lead design:

-

I witnessed that the partnership with Experian built trust in the results shown. We decided to include the Experian logo early on in the journey and also links to their website as many had (surprisingly) never heard of Experian but still thought the logo looked 'credible'.

-

People needed more clarity on what the 'levels' of risk were. My observation was that anything under perfect planted doubt into those tested, though the risk level was still 'normal' or even 'low'.

-

Using the word 'possible' to show why scores 'could' be as displayed, saw customers interpreting worst-case scenario every time. I decided that wording should include lesser causes as well as the more extreme shown examples to better balance this perception.

Quick note about testing format & key:

As a huge fan of Dr David Travis, I adopted a similar user testing research approach that includes a key to help log and follow insights and observations in user testing. The extra insight was valued by NatWest and led them to request me as lead researcher on new prototypes and beta testing for other areas of the business.

Below: Summary slide from final user testing playback to team

FOCUS ON

Remote Covid Hub discovery workshop with 50+ people across Natwest, Mc Kinsey, and Experian

The workshop I created and facilitated was not only to kick start the NatWest Covid Business Hub, but also to prioritise financial tools that we were going to later beta on the platform.

It was also my first conducted remotely with 50+ people on zoom rooms. Surprisingly (I'm a bit of a pesamist. Or realist?) it was actually really successful and worked incredibly well.

First workshop task: Find the most at risk customers and how we can help

After the warm-up, we collated existing business customer types that were going to be most affected by Covid-19. I created a key and structure to the workshop that would allow assumptions and facts/data to be easily visible, then together as a team we voted on a risk rating to help prioritise customers.

Second workshop task: Agree a vision of key areas and customer prioritisation

Using voting and assigning key members of the team as decision-makers, we gradually built up a picture of who and what we needed to focus on for first release of the Covid Hub

Below: Defining themes & epics from personas

Below: Group voting results to prioritise site features and content

Below: Initial user story creation for creation to support backlog

Summary

It would be a lie to say this project was not challenging on a CX and human level. Interviewing business owners who were deeply distressed and worried about the impact of Covid-19 on their business, staff, and their livelihoods was at times a humbling experience.

But working so closely with NatWest and being chosen partner to lead on page and tool design was a great career moment for me. We had only previously worked with NatWest for 10 months, yet they chose us to lead on some of the key service moments during the initial Covid months - a great compliment and appreciation of our clear and focussed ways of working.

More examples of work

Sainsbury's Supercharging SmartShop

A retrospective look at my role in understanding the SmartShop customer - and its innovation

CX Lead | Workshops | Research | Experiements

B&Q Kitchens

What could the future kitchen buying experience look like? We were commissioned by B&Q to conduct rapid research, CX audits, future journeys, validate opportunities and conduct a large opportunity survey to understand the perceived customer and business value

BNP Paribas

A new Global Head of Digital for the number 1 bank in France commissioned us to look at new ways to streamline and empower employees. As Lead UX on this project my team created an iPad app that would utilise existing client data and drive opportunity and sales